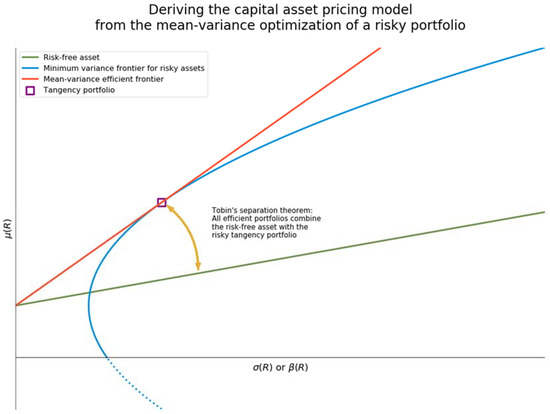

Lecture 10 The Capital Asset Pricing Model Expectation, variance, standard error (deviation), covariance, and correlation of returns may be based on. - ppt download

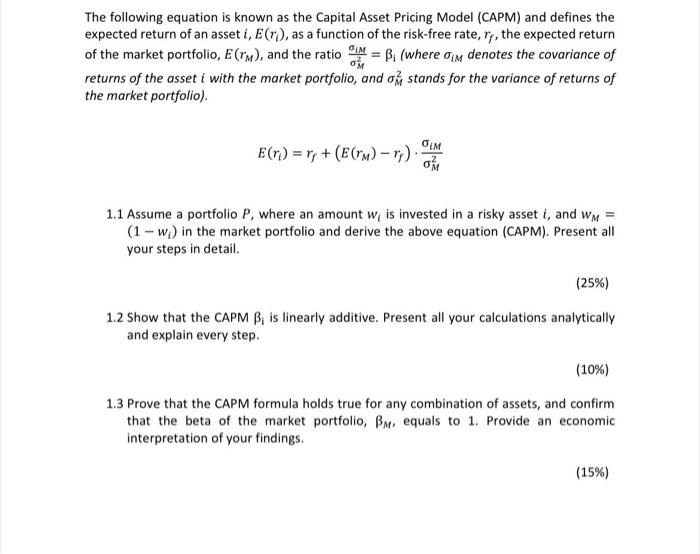

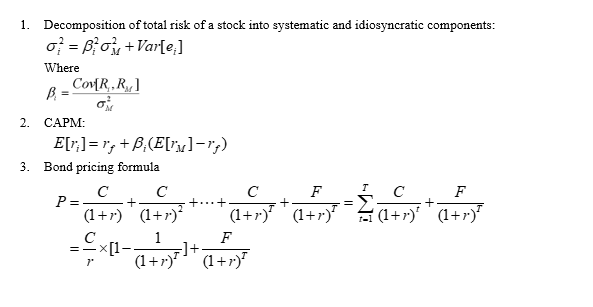

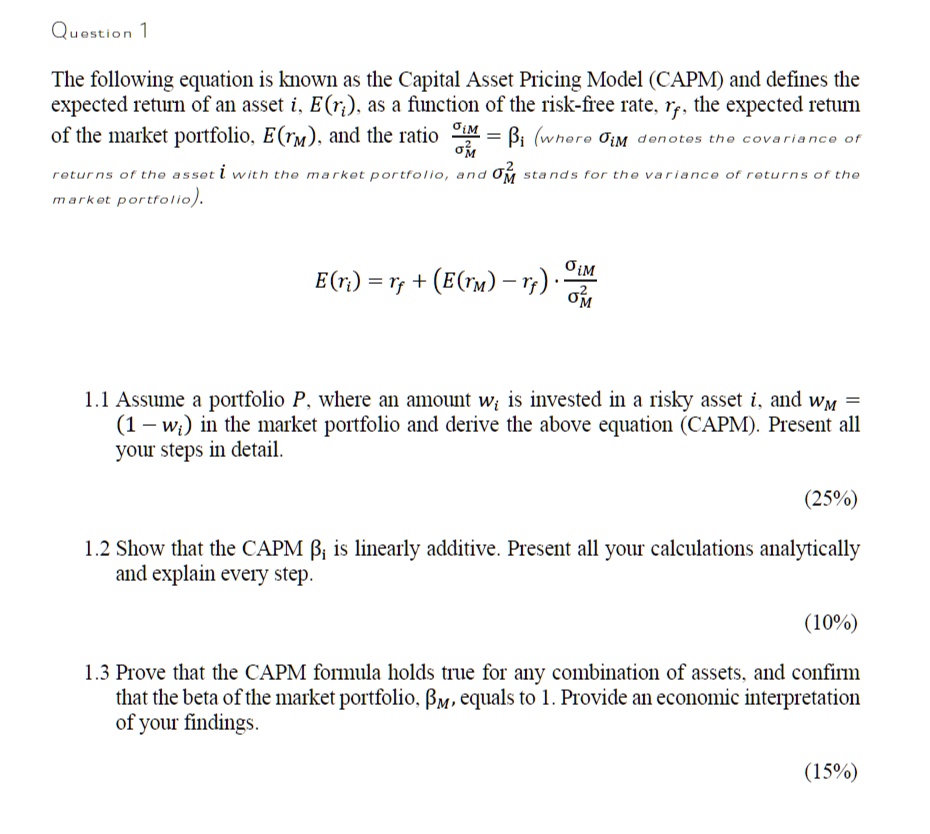

SOLVED: Quostion The following equation is kown as the Capital Asset Pricing Model (CAPM) and defines the expected retu1n of an asset i. E(ra). as a finction of the risk-free rate. rf.

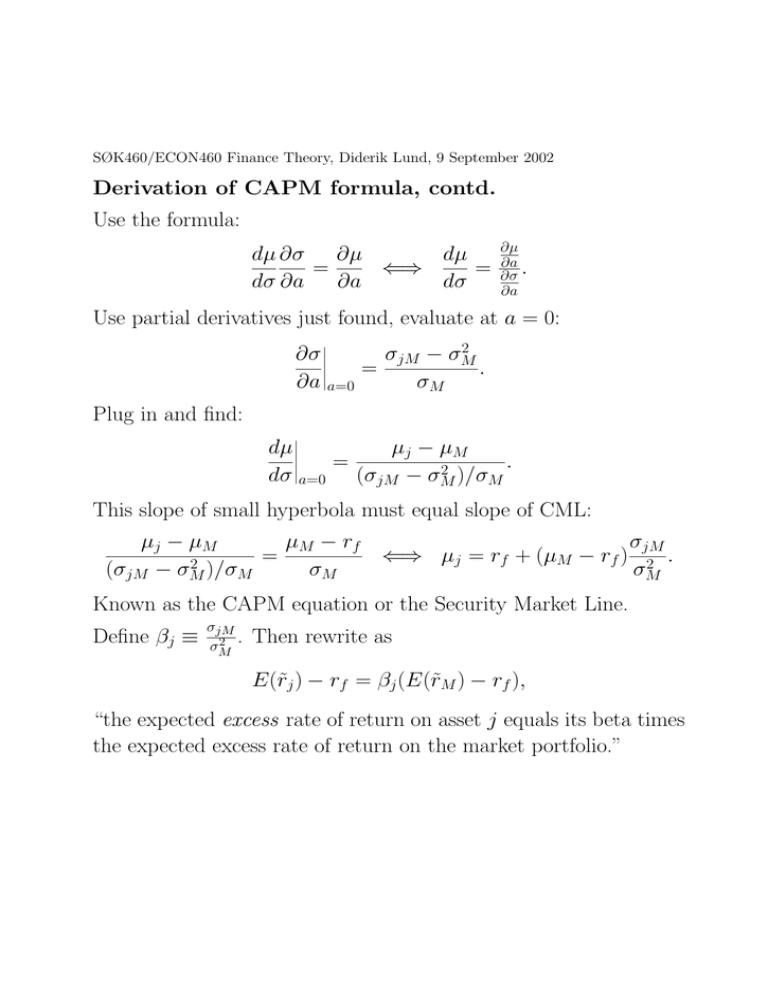

Fin 501: Asset Pricing 11:41 Lecture 07Mean-Variance Analysis and CAPM (Derivation with Projections) Overview Simple CAPM with quadratic utility functions. - ppt download