CAPM: theory, advantages, and disadvantages | F9 Financial Management | ACCA Qualification | Students | ACCA Global

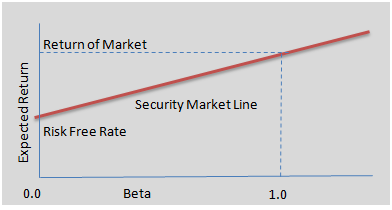

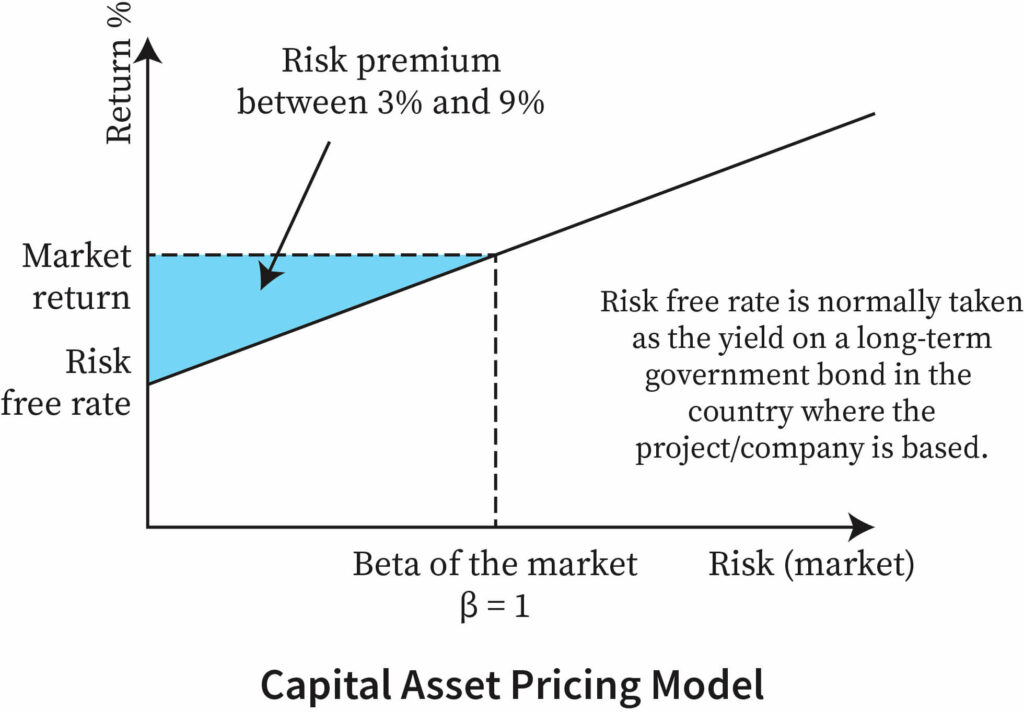

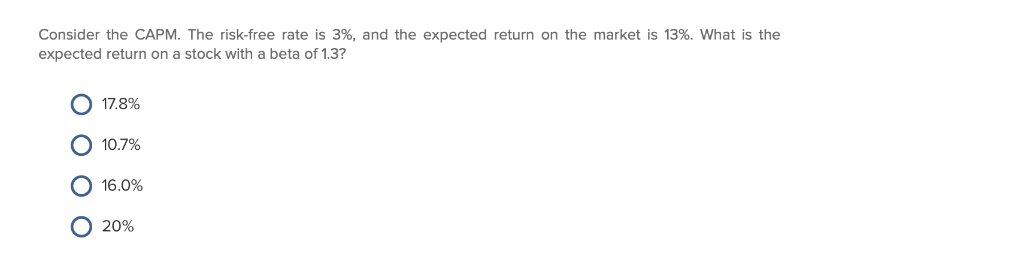

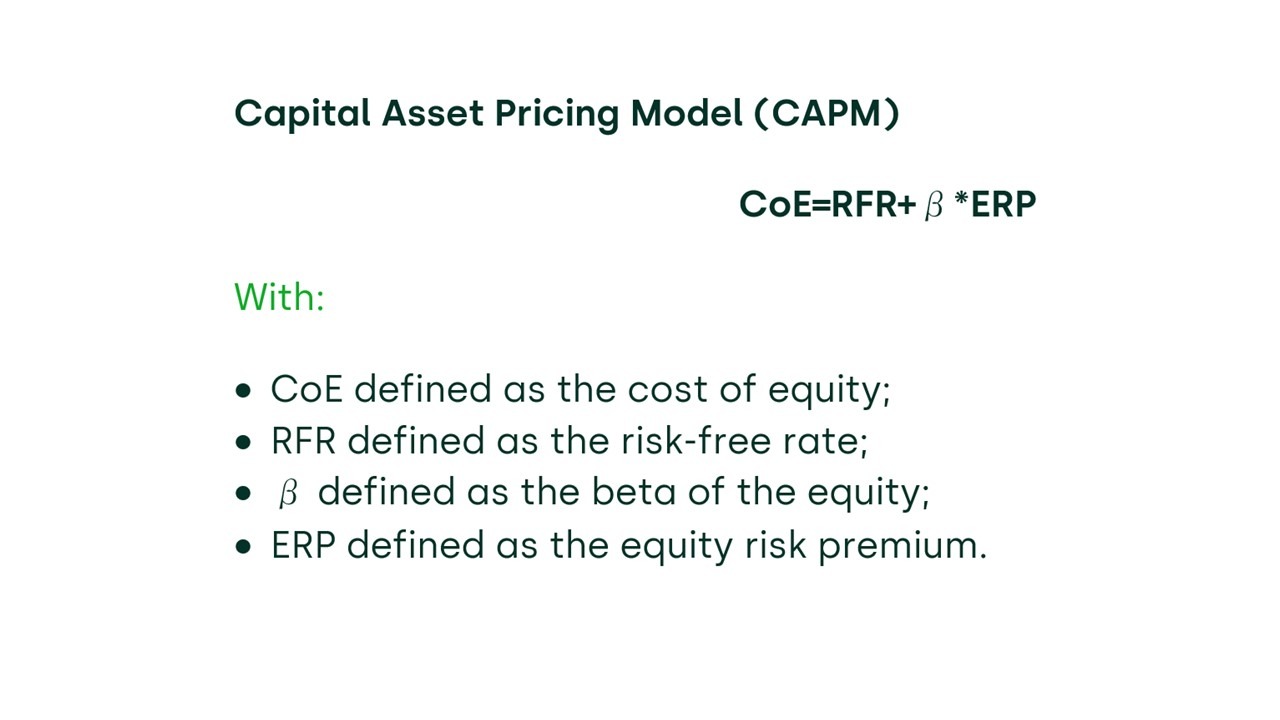

Assume that the risk free rate of interest is 3%, the market risk premium is 5%, and that the Betas for Dell and General Mills are 1.2 and 0.8 respectively. According to

:max_bytes(150000):strip_icc()/dotdash_Final_How_Risk_Free_Is_the_Risk_Free_Rate_of_Return_Feb_2020-96f00395de3d40668f31522801756339.jpg)

:max_bytes(150000):strip_icc()/CapitalAssetPricingModelCAPM2_2-b5f6378f74164191a5e589e307d88c51.png)